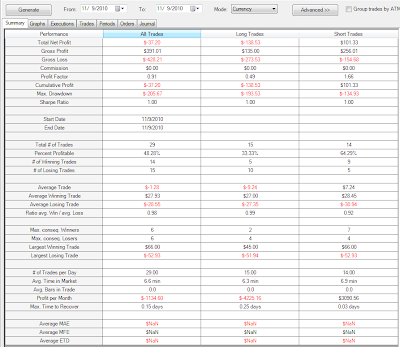

Summary:

Traded live on 100 share lots today:Keep in mind the above does not include commission, which amounted to about $50 today.

The morning was fairly un-eventful. I didn't find many opportunities, or I was late in spotting them. This afternoon started off with an early long on EOG, then calling a bottom on DRN when there was clearly no end to the sellers (unfortunately I couldn't short DRN). Then some great calls on NFLX and a timid short on SLW put me back in the money.

After the timid short on SLW though, something happened. I remember thinking that the SLW exit was silly and I was playing it too safe. I then proceeded to try and not 'play it safe' on NFLX. The first entry came off a $0.60 swing and I placed a limit on the exit and missed it. I thought to myself 'It will come back' (hope). I then got stopped and frustratingly went long at the top of the range and sat thru the bottom again after I reversed. Anyhoo - out of the rhythm for the next several entries.

I was frustrated in the moment, but I took a brief time out and jumped back in for the last 30 minutes of the day and gained some back.

Getting out early on a runner - say I misjudge the exit and the stock keeps moving - sets me up to start acting stupidly. I would look back over the last 6 months and say that this is perhaps what I have struggled with the most - even more so than getting stopped out a few times. In fact - if considering how they both affect my psyche, I would say that the two do not even compare.

It is like this (and I wonder that I have been unable to think of it from this perspective before) - getting stopped without direction happens - just the way it is. Getting out early though causes me to begin to doubt myself - 'How did I miss that SLW was going to run another $1.50 and change? I must have been afraid.' Then I begin to doubt what I see happening. The next trade (in this case NFLX) goes something like 'Time to get out. Wait - remember what I did on SLW? I missed the big move. I must have been afraid. Give it more time.' But that is the end - my focus has shifted away from price action and to myself - and whether or not I can be patient. This comes out as hope ('No one knows what will happen. It could keep moving - remember what SLW did?') which quickly turns to fear or frustration when my stops are hit - I set myself up for the biggest psyche drain of all.

When it comes down to it, this is about trusting myself - there is no way I can get every trade picture perfect and I was doing very well on my exits until SLW. Seeing how much was left on the table (after the fact) set me up for disaster. I need to be very aware of this.

To finish off the day, I had to remind myself that every moment is unique. There is no way to predict what will happen next. My decision to entry/exit has to be made on a moment by moment basis, depending upon what is happening now - not after I exited. My attitude has to be - I did exactly what I thought I needed to do at that moment - and it was the right call for the moment. I need to trust my ability to do what needs to be done. I am not going to get all the big moves and I need to be okay with that.

Fear that the price will come back or hope that a price will keep moving are sure signs that I am not trusting my ability to see.

Unbelievable as it may sound, I am still very confident in my readiness for this. I think these first few days have been the initial jitters associated with switching back to live trading. Did sim trading feel different? No. The fact that I went live - and that I post and blab about all this stuff - is far more difficult to handle than losing $85. I can think of two things to do - stop posting or start only posting my successes. But heh... The blog allows me to process, this is me, and this is real.

And it may eventually help some other poor sap trying to figure out how to do this trading gig for a living... that is, after I am successful and suddenly everyone finds I have something worthwhile to say...

Trade well.

Details:

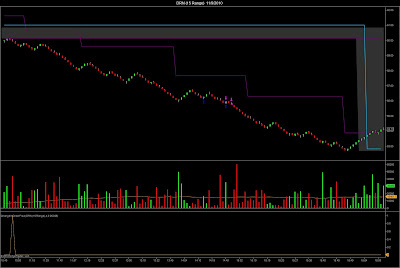

Note - there is an extra 'indicator' on the 15's that I forgot to take off. I don't use it for trading - at all.I just keep forgetting to take it off...DRN

EOG

FCX

NFLX

SLW

yeah buddy! i can see that DRN long with the higher low, bummer you couldn't short it. i'm surprised, usually IB is pretty good with their short list. with lightspeed, you can call them if the stock is hard to borrow and they will try to locate some. maybe IB would do that as well.

ReplyDeletei like this: "I did exactly what I thought I needed to do at that moment". it's true, when one stock gets away from us, we then try to hold on longer to the next trade because we don't want to give anything up. but, we need to remind ourselves, each trade is a unique and independent event.

keep up the good work.

Yeah bro - thanks for the good word. Always easier to believe in ourselves when someone else does too =)

ReplyDelete