Summary:

Pfftt...

Crazy kind of ride today. I finished +$627. But take a peek at the cumulative profit curve below.

Stuck to the plan, no breaks (occasional water fill, A.C. adjustment, and snack). I was in some crazy spreads today, which didn't help matters. I never entered over a $0.05 spread position, but they would swing wildly while I was in trade.

I should say that I mostly stuck to the plan. The afternoon saw me tagging on the market momo with TNA, QLD, VXX, and EDZ. I did pretty well with them. Actually, they pretty much saved the day.

Two things today:

- I need to more consistent with definite visual stops. This needs to happen, and they need to be where they need to be. Too often I find myself thinking in terms with 'What I am comfortable with losing?' Not sure what to do exactly, but I will think about it some more tonight.

- My exits - are freakin' brain-dead. The criteria I set up is just not good. The bump in profit at 8:30 was about half of what it could of been, way too much money left on the table. Going to have to think about this as well.

I think I am going to try and use the market replay to work towards a solution. At the end of the day I want to replay and trade the big moves over and over again. Part of this momo thing has to be in the bid/ask activity - I mean master traders are seeing something, even if they can't explain it. Maybe it will help to play the big moves until I get a feel for them?

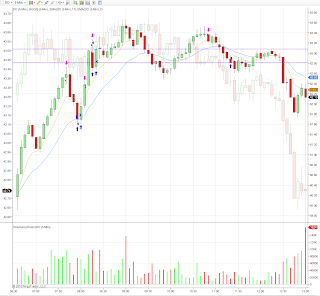

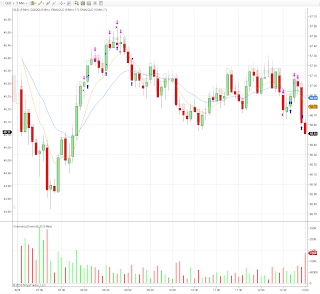

Here was the day:

Here is the unbelievable cumulative profit curve:

Heh - I was completely bummed by 12:00 today. Ready to throw in the towel on this trading business. Then I had almost nothing but winners (and the one loss was quite a bit positive before the stops). I need to drum up some consistency with this trading thing. I don't think the 12:00 run is a fluke - I am tempted to say that I do better in faster markets, but I am not sure yet.

And on a finishing note - I saw this on

Scott's blog today and thought it sounded rather profound - something to help with those anxious market moments:

'When you feel anxiety creeping into your awarenes, overwhelm it with peaceful, genuine thankfulness. And fill the moment with the power of your best possibilities.'

Details:

APA: Couldn't of done this any better, breaking support with the market behind it (-$125):

APC (+$340):

AVB: Wasn't meant to be (-$206):

AVGO: If I would of caught this last break thru support, watching the action around the prior low would of been a good (-$38):

BIDU: I think the stop placement on these left something to be desired. It looks like the first short was actually the lower one, with the stop just above the prior close. The second entry was a gut reaction - and it was the wrong thing to do - no support. The stop on the last entry has no support at all (-$231):

BP: The market was headed down, which led me to short again after that candle on lowish volume; BP didn't seem to care about the res of the market (-$60):

DO: No complaints, just wasn't meant to be (-$107):

DRI: The other trade I was in got stopped, and with the market coming down, I thought I should bail; DRI had other plans (-$103):

EDZ: heh - almost all winning trades on this one, the long discretionary exit at 9:45 being the one exception (+$590):

LLL: Well - stops galore, and finally a breakout stuck; and I traded on the downside (-$36):

MTB: This stock had a crazy swinging spread. (-$160):

OXY: just a mess - wouldn't have traded it any differently in retrospect (-$205):

PXD: Terrible exit on the first trade, I left something like 50 ticks; all in the name of sticking to the plan... The long came with green on the market, and the stop had no support. The next long was out of plan, same with the next short (no market support). The last short looked all right, but the market was not showing any kind of breakout (-$30):

QLD: Problems on the 10:30 to 11:00 positions, with only one long in the right direction - and an early exit. (+$398):

RIG: could of cared less about the rest of the market on my entries. But - I entered on OXY here as well, same direction. Need the market to break something, but it only felt like wave-ing. Out of plan (-$109):

TNA: Same patterns on EDZ, QLD, and VXX. Consistently wrong on the 10:30 to 11:00. Just a note - I kept some very wide stops on some of these trades (afternoon), opting for visual reference rather than potential loss (+$364):

V: No support for the stop (-$16):

VXX (+$461):

XEC: what to do about these long candles and new highs/lows... (-$148):