Summary:

Live trading on 100 shares today:Yipper - a definite downer. I couldn't seem to catch any direction today - either my stops were not placed correctly, I was early, or I would have a small move (~$0.40) and loss 50% of it as the price mucked around.

Looking back over the trades I was early on one exit - short at FFIV's HOD, but with the market and especially RIMM seemingly never running out of buyers I was ready to get out at the first sign of hesitation. Everything else I simply called wrong.

Bummer.

Strangely enough - I didn't feel emotionally threatened at all today. I came back into the afternoon session believing in myself and confident in my approach. I traded as well as I know how. I had one reaction trade this morning on AIZ but everything else was in the moment.

Putting things in perspective - this is probably one of the worse losing days I have ever had. At 1000 shares I would be sitting down by about $5k.

Looking back over the trades, I can't see that I did much wrong. But - it is obvious that I did. I got 'trapped' on a lot of breakouts/breakdowns - or I would play the contrarian and get hit by a stop. 10 of the 23 trades this morning had no direction (< $0.30 before stopping) and 5 of those were on AIZ (couldn't seem to sync on that monster), while only 8 trades out of the 30 that I traded this afternoon had no direction - all the others had at least $0.30. Meaning... I had the right idea most of the time, but I was against the trend. Looking at CMG, I wasn't long once, while I tried 5 shorts. Perhaps more attention to the bigger picture?

Well - I am not sure what to do. Can I attribute today's performance to a lack of focus? Emotional upheaval? I would say no. A lack of experience? Maybe. Neglecting the bigger picture? I was short 32 times and long 21... Maybe... This is a tough call, by end of a blog entry I like to have something to work on think about. Nothing comes to mind today - heh, and one of the worse performing days ever.

I look over the afternoon and I think I traded like a champ - most of the time squeaking profits out just before things would turn around and go the other way. I can definitely say that there was no fear or frustration involved.

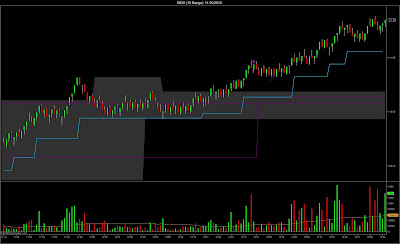

Ok - I have to make a note here. I spent a long time this afternoon writing this entry and trying to figure out what I can do/should of done better. I could not come up with any ideas. I started making things up. In fact, I even had pictures up and typed a lot of words to try and convince myself that I had found the problem. Well, thru that process I realized I was getting desperate in the attempt to find something. Then I took a look at the only my big picture charts. Pfft. It looks like I put too much emphasis on the smaller range bars today. Playing the big picture/small picture dynamic is what time compression is all about. And what my trading is supposed to be all about.

Yesterday may have set the stage for today. After the blog entry I was convinced that I needed to stay tuned to the smaller picture to avoid the 'Look what I missed syndrome'.

I swapped my charts around so the 'big picture' chart is the on the center screen and the smaller is off to the side. This should help me to focus on the big picture first.

I will finish out the week live but I think I will cut down to 50 shares tomorrow. Mostly a matter of preserving capital so I don't have to dip into savings again.

I know this might sound completely idiotic - but I think I am completely over the awful 'Fear bunnies'. They are not present in my trading. I attribute this to understanding the underlying market dynamic and keeping it constantly in mind. Today was a technicality.

I wonder how many people end up in the poor house while trading without fear?

Ha!

Trade well.

Details:

AAPLAIZ

AMZN

BIDU

CF

CMG

GS

NFLX

Yes... I was doing exactly what I thought I should be doing... 5 out of the 21 trades on NFLX had less than $0.30 on the move. Almost every new high was met with a wave of selling but the buyers would not be stopped. I had 8 shorts and 13 long trades. (Note: this was written before I realized what I had actually done incorrectly today. I looked at this chart several times - but finally really 'looked' at it and it hit me on the head. Wow. Exactly what happened today. Heh. Imagine that.)

PCP

RIMM

SOHU

yeah man, i don't like seeing a loss like that. it seems to me you are trading more stocks on the day? i thought those great days you were having involved a few trades on 2 or 3 stocks.

ReplyDeletehow come the time compression book doesn't talk about these range charts? i thought that is where you first saw them. i feel like i was just about to learn something incredible with the insight into the losing traders, but he never quite explained it fully for me. i still have a few pages left, but i got frustrated with not finding the "nut".

While I am happy that you didn't lose $5K by trading small size, let me suggest that the fact that you are trading small size is making you lose. It may sound crazy but hear me out... now you are trading from the negative and not the positive, not to win but from the damage limitation point of view- playing not to lose. Trade small so that you don't get hurt. Well I believe that psychologically you have set yourself to lose by

ReplyDeleteactually thinking about that side and thus attracting losses to you. (This is different than acknowledging the downside of every trade and putting in a stop loss btw).Think about not spilling the red wine on the white carpet and more often than not you end up spilling the wine. Its the law of manifestation, you become what you think about most. If deep down inside you know you have a handle more often than not on the probabilities from doing technical analysis, and applying your edge relentlessly then you will go and trade your "normal" size whatever that is. This is not a challenge or dare of any sort, this is only a point of view for you to consider on this long journey. Consider if champions of any sport would approach their game as you are approaching yours. You have to know with every fiber of your body that you can win , that you can trade your edge and get results in all market conditions you choose to trade in. This is the driving motivational force that feeds on itself and makes the positive future manifest itself.

scott, that is some awesome thinking. i feel its the same thinking you apply to your trading. it's like you are always on the other side, out thinking the market. it makes perfect sense, by trading smaller than your paper trading, you are already in the frame of mind that you are preparing yourself for small losses. not having the winners mindset.

ReplyDeleteit may have been you who talked about a situation where a football team who is winning, ends up losing it in the 4th quarter, because instead of playing to win, they are playing to protect their points, or not lose.

dtf, some serious mind games. i love it!!

Good words - thanks for the input guys.

ReplyDelete@josh:

You are right bro - all the trades should of been the clue.

I ran across range charts somewhere else, the book doesn't mention them at all.

@Scott:

As usual, I think your observation is spot on. This may have contributed to the last few days. But - I am not even thinking about size or winning or losing at this point. The lot size is simply a technicality.

The reality of the situation is that right now the account size forces me to trade small - if I have another day like yesterday I won't meet the minimum day trading requirements and will have to take more money out of savings.

I will likely have to anyways - but really - I think the break from live trading over the last five months has completely cleared my head and my expectations. Lot size could be whatever.

I got this thing.

"i got this thing" makes me nervous for you. but maybe, that is the attitude one needs to be successful, to have 100% confidence in one's plan.

ReplyDeleteit is possible that subconsciously you are thinking different thoughts but, my perception from the confidence you show, is that you are clear headed on both levels of consciousness. kick some ass, sea bass!