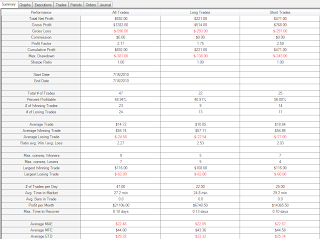

Summary:

Traded 200 share lots today and down $684.73 for the day:

Pfft.. what a day. If it would have been 500 shares, the day would rank right up there with some of the worst.

I traded a little differently today - entries came in with a stop and a profit target (50 and 100 ticks respectively). I then adjusted both to where I thought they should be visually. Thinking about it now, I did move the profit quite a bit as the stock was moving. Probably not such a good idea.

I am having an extremely difficult time with my exits - the usual. If a move got big, I was jumping out before it could get bigger. Then time and time again I had good direction and scaled in, it continued moving (>30 ticks), I usually forced myself to be patient and got stopped. The late afternoon was completely unreadable for me.

CLF looks like it is full of crazy man trades. It is. I came in short on the very first entry - and it would of held if the stop would have been set correctly, for a good $3 all day move. But - the proper stop place was some 40 ticks and I opted for 'immediate' stop on the prior candle close. Hindsight is 20/20.

What was I thinking on CLF? Most of the sequences were entries, direction and scale, or entries stops and reversals. I look at it, and I post it, and something inside of me wants to justify all the trades. The bad part about this is that often the trades had direction and in my mind that justifies the entry/re-entry. I am pretty much convinced that I need to break away from that kind of a mindset; if I even attempt to justify the trades I am setting myself up to do them again.

In line with all of this, and perhaps contributing to all the ins and outs on CLF today: I consider myself above par in a lot of areas - not the best, but comfortably in the top 1/4 percentile. Most things that I try to do I am fairly successful at; I expect the same thing is true for the vast majority of people that attempt to day trade. I think this lends itself to a certain flair - for me it becomes: 'Hey - you never know what can happen - why not take the chance? I usually get it right.' So - instead of taking only the high probability entries today, I took them all.

Turns out the stock market is a great reality check. Catching myself in this thought pattern should be a definite warning sign to slow down or quit trading. I don't know how many times I told myself - 'Try it - you never know.' (Again - this is complicated by the fact that something over 50% of my entries had good direction >20 ticks.)

Looking at the charts end of day, it is very easy to pick out the good entries. Should it be so much harder during the session? Technically - it should have been just as easy to have a $687 profit as it was to have a $687 loss.

But it is a lot harder to see these patterns in real time, and it is a lot easier to lose. Why? Because I make them harder to see and I make it easier to lose. The battle is all in my head. Nothing more.

This has to be remedied. I need two things: CONFIDENCE. In my ability to read the markets and to consistently profit from my edge; and evidently, ANOTHER source of love and acceptance (more on this later).

I was trying to explain this to my wife this afternoon - this idea that the battle is all in my head - how it is not so much about being right or wrong on a trade, it is about what happens after I am right or wrong. It didn't come out so well, but the more I do this, the clearer it personally becomes. For example - I was up 40 some ticks on the last trade of the day (CLF entry at 12:45) on 1000 shares after the scale. The only thing keeping me from realizing the profit was me - I could of exited at any time, but I exited at the top of the wick on the 12:55, for a little better than break even. The exit was about what was going on in my brain, not about being right or wrong. This happened all day today.

Time to slow down. Time to get back on plan. Time to paper trade.

The plan is the afore mentioned entry strategies - I was doing fine with these on paper. I venture out to trade live and fall to pieces...

And on another note - Tarigal and I had a great discussion today a couple of hours after market close, stemming from an entry on

Trader Psyches and Tarigal's response to it.

Why do people say they want to be a day trader? Or, more perhaps more pertinent to our discussion, what is the motive underlying the motive?

Love and acceptance?

At first blush, I was a little hesitant. I have thought about this before - a good trader needs to give himself the freedom to fail, and the freedom to succeed; I have found that this freedom - for any area in life - can only come from some outside source of love and acceptance; not in what I can or can't do, but what someone says about me outside of myself. I had convinced myself that I was above/beyond this when it comes to trading - I have other sources of love and acceptance.

But... thinking about it some more, I am not so sure. This trading thing is a big deal to me, in terms of future career path, work environment, and lifestyle. I feel that a lot is riding on how successful I am at this - probably the way it is for a lot of new traders. And look at my level of commitment: this blog (the length of this entry - lol), my weekends, my holidays, reading nothing but trading books and blogs, my lack of sleep... in short, my thinking of trading 24/7. Don't ask me about trading if you just want to make quick small talk... my poor wife knows more about trading than she ever wanted to know.

Again, I thought that I was concerned with smaller things (career path, lifestyle, etc.) - but I am not sure that smaller things would consume so much of my time; trading has become something more... On some level, I am beginning to think that this trading thing is a pre-occupation, a mis-identification of my source for love and acceptance.

Think about it for a bit. Everyone recognizes that a lot of people look to their vocations as a means of much more than income; it can become/is a source of identification; of knowing who we are, how to relate to people, and we should expect people to relate to us - or how people should love and accept us. And then there is trading...

The trading game is completely psychological, mental ability; whatever is in my head is manifested on the charts at the click of a button. In no other vocation is this concept (i.e. mental and emotional health) so clearly linked to successful outcome. E.g., sure, it is important to me how good an engineer I am, and it makes me feel good when I complete a project well, but there is a lot of time and energy that stands between me feeling loved and accepted and a good bridge design. Only a click separates trading and results.

Professional poker may be about the only mental/psychological equivalent to trading - maybe this is why a lot of the good traders draw analogies from the poker table.

I am not sure what to do with all of this. I am thinking paper trading - getting so used to feeling like it doesn't really matter (while at the same time garnering additional chart reading skills) that when I start trading live I can readily find that spot in my head again. Maybe. That coupled with getting a life outside of this trading thang.

Well anyhoo... this is long enough. Details follow, the new idea section follows that.

Rest well. Trade well.

Details:

(A note on the charts: entries are always on the left side of the candle. Pink means sell, blue means buy. The exits are on the right side of the candle with the same color definition. Coming in short (pink) requires a long (blue) on the exit.)

Market action and my lines:

ABX (+$100.93):

BTU (-$37.48):

CLF (-$203.84):

CLF - the 1 minute against the 5 minute to show direction on trades and what I ended up missing. Not quite as crazy as it looks...

CTRP: The first stop was a killer - I didn't check the distance and went by the visual. Problem is it had already dropped $7 (-$306.01):

CTRP - the 1 minute against the 5 minute, to show direction on the trades and what I gave up:

GG (+$31.62):

LVS (-$195.52):

V (-$73.45):

Ideas:

So - I am adding a new section to each entry - I am going to call it the Ideas section. Going to take one stock that I traded and pick out the most efficient entries and the most realistic entries. Get my brain familiar with the patterns

I took another look at the CLF chart and picked entries (beginning of line marks the entry bar):

++7_6_2010_good+entries.jpg)

Some 11 short (red lines, left side of line in entry bar) entries and some 9 long (blue lines, left side of line in entry bar) entries. All require perfect timing and some kind of uncanny trading sense. Impossible for maybe anyone but Scott, but there they are. (I missed the 7:40 doji, so add another short to the list.)

Here is how I traded it:

++7_6_2010_entries.jpg)

I hit all the good spots and then some.

Now - highlighting all of the entries that gave some type of real time hint at what was to come; e.g., long wicks, long candles, resistance/support lines, etc. I highlighted the respective entries and the potential signal:

Nothing new here, I just want to re-enforce these patterns in my mind.

+_+QQQQ+(15+Min)++7_16_2010.jpg)

+_+EDZ+(15+Min)++7_16_2010.jpg)

+_+QLD+(15+Min)++7_16_2010.jpg)

+_+TNA+(15+Min)++7_16_2010.jpg)

+_+TZA+(15+Min)++7_16_2010.jpg)

++7_16_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

++7_15_2010.jpg)

+_+%5ETICKQ+(5+Min)+_+%5ETICK+(5+Min)++7_12_2010.jpg)

+_+%5ETICKQ+(1+Min)+_+%5ETICK+(1+Min)++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

++7_12_2010.jpg)

+_+%5ETICKQ+(5+Min)+_+%5ETICK+(5+Min)++7_9_2010.jpg)

+_+%5ETICKQ+(1+Min)+_+%5ETICK+(1+Min)++7_9_2010_better.jpg)

+_+%5ETICKQ+(1+Min)+_+%5ETICK+(1+Min)++7_9_2010_better.jpg)

++7_9_2010_buysell.jpg)

++7_9_2010_Scott.jpg)

++7_9_2010.jpg)

++7_9_2010.jpg)

++7_9_2010.jpg)

++7_9_2010.jpg)

++7_9_2010.jpg)

++7_9_2010.jpg)

+_+SPY+(5+Min)+_+%5ETICK+(5+Min)++7_8_2010.jpg)

+_+%5ETICKQ+(1+Min)+_+%5ETICK+(1+Min)++7_7_2010.jpg)

++7_8_2010.jpg)

+_+SPY+(5+Min)++7_6_2010.jpg)

+_+ABX+(15+Min)++7_6_2010.jpg)

+_+BTU+(15+Min)++7_6_2010.jpg)

+_+CLF+(15+Min)++7_6_2010.jpg)

+_+CLF+(5+Min)++7_6_2010.jpg)

+_+CTRP+(15+Min)++7_6_2010.jpg)

+_+CTRP+(5+Min)++7_6_2010.jpg)

+_+GG+(15+Min)++7_6_2010.jpg)

+_+LVS+(15+Min)++7_6_2010.jpg)

+_+V+(15+Min)++7_6_2010.jpg)

++7_6_2010_good+entries.jpg)

++7_6_2010_entries.jpg)