Summary:

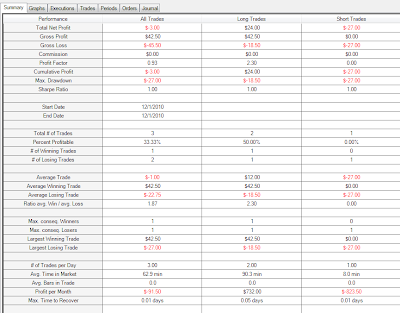

Paper trading on 50 share lots today:

A great morning and a losing afternoon...

And I was relatively surprised to find out at EOD review that I was trading out of plan this afternoon. I traded several corrective waves expecting in the primary trend direction (expecting continuation)... For some reason I completely forgot to draw waves during the afternoon session. The lines would of kept me out of a lot of stops.

Thinking back over the day I want to attribute the afternoon trading to a couple of things. First - I saw plenty of long opportunities and my approach was not allowing me to go long. Rather than carefully considering what was happening I jumped in on which ever stock was allowing me trade - by only looking at the indicator (price crossing the short MA with color). This cost me 1/3 of the day's profits.

Anyhoo - I had 3 stocks with $2/share gains at one point today. It began to get very difficult when they started coming back. I managed to get decent exits on them, but the emotions were just under the surface. Funky.

I am reading and finding out a lot about price action (via Al Brooks) and wave patterns. I am sorely tempted to switch up my system again.... The bane and downfall of new traders - an inability to stick with a decent and workable plan?

The thing is - today I missed several opportunities, and I hated it (the short opportunity on both NFLX's and CRM's crazy morning runs and long opportunities on them and both and CMG). I had to sit on my hands. In some ways I think this is actually good for me, i.e., forcing me to be disciplined and patient. But at the same time I seem to be biding my time and trading 'any' opportunity that my 'indicator' (price over the MA) says I am allowed to; kind of like a blind reliance on the system rather than on myself.

Input sought, welcome, and appreciated.

Anyhoo - I think for now I will stick with the plan (and try to trade in the plan). I think it has the potential to be very profitable. But I plan to keep studying price action (Al Brooks does a great job and should have

a new edition of his book coming out (thanks to

Fozz for that link)) and wave patterns.

Price action is fascinating. Honestly, my approach to the charts has been mostly about taking/making a guess - and calling it intuitive, I have had a very hard time describing where/when/who/what. I would see people write about 'early shorts are setting stops here' and wonder what in the world they were talking about. I would try to puzzle it out but did nothing other than confuse myself. Is this what I would do? How do I know someone else is doing this? Why are there early longs/shorts if they know they are early? How do I know that they are early and right rather than early and wrong? Etc., etc. From the little that I have read, Al manages to do a great job of describing the story behind the price. The reviews that I have read would suggest that the book is not very well written - and he himself readily admits as much. I am looking forward to the second edition.

Trade well!

Details:

I siwtched up the way that I draw the waves and am now placing the lines right on the respective highs and lows. Again, I drew sets on the morning's entries, but somehow forgot to on the afternoons. When the pattern failed to materialize (usually the 5th wave) I assumed something other than trend was going on and waited for the next breakout for the first leg. Amazing how this works out.

AAPL

AMZN

CF

CMG

FFIV

NFLX

UPRO