Summary:

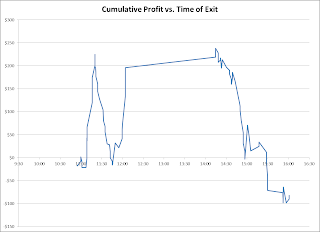

Paper trading 200 share lots today:The morning was fantastic. The losses resulted from a series of entries taken on the short side as new lows were being touched. I turned everything around after the stop and played them long, the Q's supported the move and I made everything back up again.

The afternoon became an exercise in futility - the Q's were giving me ulcers; fast candles thru S/R only to have them immediately come back. I was playing the wrong charts at the time.

Stops in the afternoon were more generous.

Largest stops:

NFLX at $0.31/share.

Largest wins:

NFLX at $0.62/share.

Again - the morning felt easy. I took a break thinking that I have got this thing. I could see myself never being negative.

Heh.

What happened this afternoon? (Seems I ask this question a lot lately...)

I tried to trade charts using the Q's. And the Q's were a mess. This had me scalping on some very pretty charts (PAY, BG, and FCX; ready for $1.70 and $1 moves on BG and FCX respectively). How can I avoid this? I don't recall how much attention I was paying to the Q's this morning, but I was seemingly fascinated with them this afternoon.

I am beginning to think that pretty charts need to take precedence over the Q's, especially a sloppy set of Q's. Interestingly enough, looking at the 3:15 on the Q's (it was a flash down after the prior candle flashed up thru resistance), it brought BG down with it (definite panic, green with a long bottom wick), FCX went up with the prior flash up (not greed, but good and strong), but didn't come down with the flash down (made a doji). (Edit: I marked all the 3:15 candles and added PAY for good measure.) Just things to note:

In effect, the momo of the stock over-rode the silliness going on in the Q's, but if the Q's flashed in accordance with the stock's tendency, the stock pushed stronger.

On the other hand, when the Q's are serious, say like this morning, the Q's over-ride the stock's momo (ACN and Q's/SPY):

ACN was going up strongly, setting new highs on volume, and the Q's plunged, bringing ACN down with it. Notice that the Q's being flat in the half hour proceeding had no impact on ACN.

Just food for thought - something to help me remember what the Q's are good for. After today's afternoon session, I decided I need to try and understand and make some distinctions.

Interestingly enough, after reviewing the day's trades, it became apparent that I was willing to scalp on some stocks - but not on NFLX. I kept looking for some direction on NFLX, or at least bigger moves then I was getting (+0.30). The Q's were flat (with occasional breaks to the top). Probably more importantly - NFLX was flat (i.e., flat relative to the day's price action - the last 1.5 hours of the day saw a range of better than $1.50; see the chart for more comments).

In hindsight, it looks like the only mistake I made was the persistent NFLX trades (or not scalping them) and not holding the trenders. Another lesson.

Trade well.

Details:

ACTGAGU

ANF

Couldn't quite pull this one off, seemed to be a little early:

BG

Q's had me scalping. Riding half of this trade would of more than made up for the day:

CLF

CTSH

DLR

DO

FCX

Again, Q's had me scalping... would of been a fine finish to the afternoon:

FLR

A little early on the breakout:

HPQ

I was ready to take a break:

IMAX

MAN

Again - break time:

NFLX

Ok - Q's should of had me scalping in the afternoon - but I kept seeing flashes and even dollars. Should not of been trading this chart; but again, I kept seeing resistance and support being broken on the Q's. Looking at the chart now I realize I broke my new rule. NFLX was technically trending down all day with lower highs and lower lows. My first trade in the afternoon had the right idea, but the resistance level was not very well defined (because NFLX was not moving much in comparison to the rest of the day's activity). After what I was calling the new lower high failed (three attempts at the short in a row), I should of re-thought my approach :

OXY

PAY

Q's had me scalping (why this and not NFLX??)

RE

VECO

WIT

XEC

Saw this way late in the day:

again, i didn't realize the SPY had a much cleaner chart.

ReplyDeletei know why you weren't scalping NFLX but were with PAY and FCX. Preconceived notions. You believed, and rightfully so, that NFLX can run 1,2,3, etc... dollars so you hung on in hopes of a bigger move. With PAY and FCX you may have believed that the stocks would only move .50 so to get .30 (or whatever you believed or got) was a nice piece of the move. Instead you should have just traded the charts with no preconceived notions about what is possible. Remember...what if?

Hmm - I think you are right. Gotta keep that 'what if' theme going... but only when it should be gong lol.

ReplyDeleteLooking at BG now - I see why I got out - new low and it re-traced and turned into a hammer. It had so far to go though...

PAY and FCX - like you pointed out - trending all day.

It is a stretch to say NFLX was trending slightly lower, but I guess it was technically.

Oh well, some regrets today. Gotta believe.