Summary:

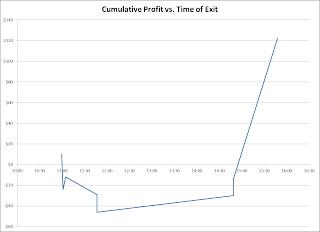

I am excited and glad to say that I spent the late morning and all afternoon being consistent.On a side note, I finished at +$122 (paper trading 200 share lots of TNA):

Pfft... who am I kidding - I am ALWAYS more excited by the profit at EOD.

I started today determined to stick to the plan. I did for the very first entry... then things fell apart. I came in short on a 15 minute doji signaling a long, which left me second guessing. So after the 5 showed indecision off the day's low, I reversed; then second guessed that decision and reversed again. I then decided that I was nuts and closed the position and took some time to reassess.

This is crazy. Despite my best intentions, I was out of plan 2 times within the first 10 minutes of the first trade. What happened?

Part of the problem was that I hadn't encountered this type of a pattern while using the plan. This left me second guessing my decision to enter. Truth is, every situation is unique, so I need to get used to this. I believe that the real reason for the back and forth was that I had not fully acknowledged and accepted the risk - I was not prepared to be stopped on this entry. I think this stems from focusing on the wrong goal: profit.

It took me about 20 minutes to work thru what was going on in my head. Initially I felt that I had ruined the whole day because I was already out of plan and that I was a complete idiot for not being able to follow and stick to some simple guidelines. I had to convince myself that the morning's mistakes didn't define me as a trader and that I could start over with the very next decision and stick to it with the best of my ability.

I apologize. As recent as 6 weeks ago, if someone would have mentioned that good trading is all about the thought patterns outlined above and that this was the real problem for traders, I would of said 'Yeah - but not me, talk to the next poor sap'.

Belief systems are powerful, especially the one I am trying to come to terms with in my trading, it has 30 plus years of social and academic structures supporting it. I think it centers on the fact that our culture uses money as the measure of success; that I use money as the measure of success. I am not sure that I quite understand it all yet, but focusing on profit is what I am used to doing, it is what I have been consciously and unconsciously told and taught to do my entire life. I am beginning to understand that in trading, focus on profit is a distraction. It is not that I don't want profits - but the path to profits is consistency, profits need to be the deferred goal, consistency needs to be the immediate goal.

It sounds so simple spelling it all out like this, but it is so easy to lose sight of. Incredible.

Douglas talks about diverting energy from one system to the system you want to have. I am determined to stick with and complete the exercise, it might just take a lot longer than I think.

Trade well.

It's good you didn't toss your whole day out after that one mistake. I know I can definitely succumb to that attitude, but the market is so great. You make one mistake and the next trade is a completely new "day" so to say.

ReplyDeleteSo true.

ReplyDelete