Summary:

How should I describe today?It was a glitch prone morning . I started off without checking ATM order size and was in on the first position at 100 shares. As it returned to entry I decided to go ahead and try to get a 200 hundred total lot size and ended up with 300 shares. For some reason this really flustered me. Go figure. I then promptly screwed a few more orders up and forgot to add a couple of positions to the MA so I didn't watch them until they got stopped. This really threw my game off, but I took a couple of breaths and remembered how much fun I was having.

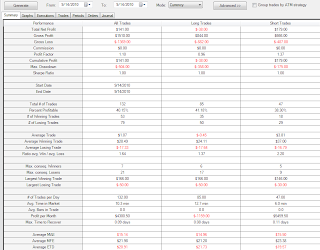

I had some big winners today, I pretty much nailed V (profitable trades vs. trade size, biggest profits):

Losses were all within line at < $0.30 (losing trades vs. trade size, most negative of the bunch):

This afternoon I lost focus - the lunch time chat spilled over into the afternoon session and I promptly made several very stupid trades, 3 on NUVA which I had traded very well in the morning. At 3:00 I finally came to my senses, but by then most of the damage was done and all my positions were headed for more. The afternoon channel should of had me taking any profit I could get.

Only three trades had me on edge/anxious about, one was the long position on RDWR. The spread was large and the action was pretty much stalled. I don't mind a larger spread on a fast mover, but $0.10 to $0.20 on a stalled stock makes me jumpy. Very hard for me to read what is happening. The other two were wide-spread high-priced shorts on MA and ISRG. I think the high price of the stocks and relatively fast uptick on both of those warranted the wide spread, but the chart reading is much different versus low-spread behavior. I left quite a bit of money on all three trades.

Other than the clerical/order management morning and missing focus afternoon, the day went well. Kept it upbeat and fun outside of the RDWR long. I am definitely learning a lot, paying attention to and focusing on the market and stock interaction - it is pretty cool when things click. The ascending/descending triangles seem to coil stocks up - they tend to move when they break out. I am not as consistent as I could be with trading those - sometimes trying to get the turn around or seeing the pattern too late. I picked out a few for the detail section, some work, some don't - and some take quite a bit of imagination to see; most of them were drawn live, but a few were after the fact.

Trade well.

Details:

APA:APD:

AVB:

DNDN:

DO:

EOG:

ISRG; wide spread - ton of money left on the table:

MA; wide spread, ton of money...:

MDY:

NUVA; traded the morning session like a champ (err... with a few too many exits, but hey, I am still a newbie - I got back in), but the 3 consecutive longs in the afternoon... what was I thinking?!? I haven't done that in awhile:

RDWR; didn't mind the short side at all, the halting long with the wide spread was a tough one to hold. This didn't show up on the screener that I usally watch for fast movers due to the low average volume. It caught my attention on the new H/L ticker way late in the game:

RIG:

RIMM; the big move early in the day had me thinking maybe the afternoon would develop as well, which had me justifying the late entry on the breakout:

ROVI:

V; Ah.... wish they would all work out like this, added the third triangle after the fact:

X:

well done dtf. you are a trading machine. see it, trade it. freakin' ROVI. man that was a nice one. i'm remembering there was one more great looking chart today. i am going to see if i can remember what it was. so much opportunity every day, just need to get on the right side of it.

ReplyDeletecome on!