Summary:

I got back from SD Sunday afternoon and spent about an hour in the evening troubleshooting the computer problem. Turns out Windows 7 has pretty good crash reporting and after running the memory diagnostic put the blame on two of the Corsair modules. So I pulled them out and running at 4 GB until I can get these RMA'd. Hurrah for Windows 7. I am impressed. (New comp coming a week =p)

Had a great weekend. No computers, but of course the trading analogies kept coming up...

I should explain that I have tried surfing several times (all of 3 times prior to this weekend when it comes down to it). Each time consisted of renting a surf board and a wet suit and heading out to the biggest waves I could find. I have always been fairly athletic - I figured how hard can it be? Heh. The first time I went out, I swam out to where all the other surfers were and promptly got my a$$ chewed out by some surfer chick when I kept getting in the way: 'You are going to get yourself killed!' Pfft.

She was probably right.

Well... I didn't kill myself, but I am sure that I managed to look like a complete imbecile the entire time. I don't mind the imbecile part - but I didn't learn to surf either. Here's hoping I can be smarter about day trading.

We had an old timer for a surf instructor (http://surfarisurf.com - great outfit) and he explained that he was going to teach us 6 years of knowledge in about 30 minutes on the beach. I was a little doubtful, but he had us standing up by the second wave. We spent the entire day in the foam, but it was a blast. My son is hooked and dad may as well be.

Our instructor shared a timeless insight: 'The ocean is a patient, tireless instructor.' Watching the waves and my son fighting against them while trying to position for the next one, Scott's affirmation MP3 came to mind. Working with what the ocean offers is the only sane approach. Patient. Relentless. Powerful. Free. Go with the flow.

After one particularly big tumble my son shared some insight as well: 'Dad - surfing is just like trading, huh? It seems so simple but kind of hard to actually do.' For sure.

We finished up the weekend with a visit to Morley Field - the only pay-to-play disc golf course in the entire world if my sources are correct. I came in at 9 over but it was a blast. And it was a morning spent without bad trading analogies. =)

(Yes - I introduced my son to the trading concept. I am thinking about setting him up with an NT license with delayed replay data just to see how he does. If he ends up enjoying it, can you imagine the head start?)

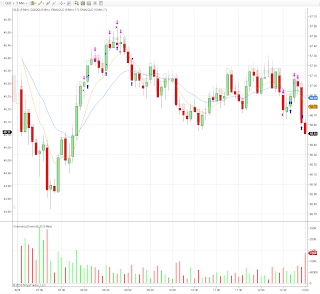

Anyhoo - today was positive at +$880:

NT is showing 109 trades, but to give you an idea of the actual trades, I entered one time on GS (500 share order) but NT registers the entire sequence at 7 trades (partial fills coming in and out). This is about as bad as it gets, average is perhaps 4-5.

Here is the cumulative profit curve (forgot to add earlier):

Trading felt different today, it may have been the weekend break. I didn't seem to have this 'I have to make money right now' attitude. I was content to let the market do it's thing. Maybe because I have been paper trading for over a week now? I hope not, it felt good.

Interesting trades to note: the 8:50 sequence on EDZ, VXX, TNA, and QLD. I exited almost all of them at the worse possible time. It seems I do that a lot. I was expecting to see some resistance at the 45.35 level on the Q's, and we still had a ways to go. As things fizzled, I flattened everything; after which of course, the trend continued (it then fizzled for sure at S/R, but momo pushed thru to the next S/R). Mixed feelings about that, not sure what was telling what what to do: gut, right side brain? There were definitely some emotions attached to the exits. I am going to guess that experience will help clear/sort this out. Here is how I interpreted the market today:

Only 4 S/R lines.

Details:

AFL (-$127):

APC (+$1)

EDZ (-$43):

GLD (-$93):

GS (-$82):

IYT (-$95):

MYGN (+$430):

QLD (+$210):

RGLD: I had noticed this and DGP and GLD earlier; then RGLD lagged as DGP and GLD dropped, so I shorted and waited (+$168):

TNA (+$463):

VXX: (+$48):

yeah buddy! nice day. you and i were both going at that QLD on the highs. it annoying they kept getting me out, and i kept shorting again. man, i was having fun though. i love the analogies. but boy, are they ever so true. i surfed a decent amount on the jersey shore, and its true, you need to wait for the set and then the right wave. same thing in trading.

ReplyDeletequick question, how do you post on outlier daytrading, anyul site? the verification box is always blocked.

and if you go to draft.blogger.com you can upload multiple pics (charts) at once. and then cntrl and select the ones you want, and it will upload all of them. just not 5 at time anymore.

Yeah - I was just reading over your post - some good trading today!

ReplyDeleteI think I press tab when it asks for verification.