Summary:

2/2 on the consecutive day tally.Down for the day - drastically (-$258). Paper traded 100 lot shares. A lot of stocks today, but not many trades:

I think 56 trades (per NT) is a minimum for me (since starting this style of trading). But I still lost a lot of money (relatively speaking). The shorts far out weigh the the longs, and I am sure this had something to do with my skepticism for the entire afternoon rally. I did not expect the rally at all and jumped on board too quickly - as I thought I saw signs of it failing.

The morning session went pretty well. No huge moves, but came out on the positive side. I was paying more attention to the market then I was individual stocks, looking for the market signals and trading candidates. It seemed to be working pretty well. I felt that my concentration was up and I was tuned into what was happening.

Things went all awry this afternoon during the rally. I was positive until 11:40. This caught me out on attempted shorts for several stocks, and good ole' TNA several times. I went short 18 times and long 7 times (VXX and an uncooperative RIG) between 11:40 and 12:50; almost 1/2 of the day's trades. Rather than catch the ride up, I fought it all the way to the poor house lol.

A lesson here? Get in the moment. Any thing can happen. Do not anticipate. Patience with the candles.

Details follow. Again, not a lot to look at or learn from (God forbid), but if you have any insights feel free. I think I had 2 early exits, and 2 delayed exits (ignoring a clear reversal signal). Needless to say, my wife is glad that I am paper trading these days.

Quite a run of negative days... but tomorrow - ahh, tomorrow. I am sure everything will come together tomorrow. Trade well!

Details:

Anticipating a return to the trend on AMAG (-$10):

Anticipating the market reverse on APA (-$3.00):

Covered as the candle went green on APC, which ended up being much too early (+$12):

Looked like BP was setting up for a free fall with the volume tapering off on the new high (-$13):

BXP tested the new low, but the market was setting up for the rally (-$16):

CLF decided to follow the market lead (+$9.00):

Anticipated CXO's additional highs. Unfortunately stopped the reverse was a little early. This was a different read, but very nice lazy corrections (+$47.00):

Short on DRQ on the 12:00 market doji, I felt the reverse coming. Wrong. (-$12.00):

Trying to play the candle change, then I got a short coming off of the doji. Wasn't sure what to make of the green increasing volume and all of the long wicks, so I bailed. The 8:55 doji was a great setup. Expecting the market to reverse and FTI looked like a great candidate in the afternoon. I doubled up - and I was negative when I did... go figure (-$16.00):

GG triggered the TDA alert and I came in with a late short (-$10.00):

HAL: Anticipated a short opportunity on the candle change and got stopped for it. In the afternoon looking for the market to turn around and shorted (+$8.00):

Looks like JOYG was one candle behind the rally - would have been good to see that rather than the short opportunity I thought I saw. $0.05 slip on the stop (-$20.00):

Expecting the market to freefall and OEH to go along for the ride (-$7.00):

Early exit on OII with the strong green on volume (+$26.00):

I thought I was golden coming off the doji and hitting the new low for PVH. Looks like it was lagging the market at the time, while I thought it was returning to trend. THis would have been a good stock to latch onto (-$8.00):

PXD looked like a candidate for the reverse on the rally that I kept expecting (-$10.00):

I just wasn't able to read RIG. The first short looked good and in line with the markets. The second short looked good as well, again with market support. It worked for a bit and I let it go to the stop. Breaking the entry candle high should have been a sign? That and maybe the market's subsequent indecision. 8:45 marked the first try at a long coming off the doji. I am not exactly sure why the exit, but it ended up being a good thing.

The 9:15 short came in mid candle and after a market doji. This didn't work out so well either and I think I exited as the volume broke above the prior bar.

Long on the candle change (I think this was the only time I tried to follow the market lead during the rally), and it got stopped with on a $0.05 tick stop. I went in again as the candle went green and the market was going bonkers, then doubled up some 20 seconds later as it dropped and the market was still going crazy. Stopped out (-$35.00):

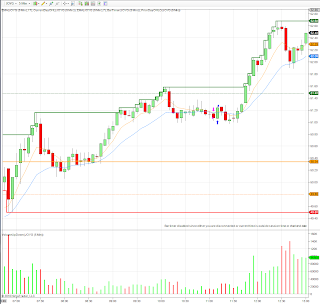

Some controlled, market led trading on TNA this morning, but plenty of stops. I was 2/4 and slightly negative. Then I anticipated a reverse on the rally and it never materialized. The 12:20 short was the only candle change entry, all the others were based on red or market activity: the 11:50 came on some market indecision, the 11:55 on the seeming stall after the candle change (0:32 mark), the 12:00 on the retrace and red, so on, and so on. Only two profitable trades on the afternoon.

I was fighting the trend, I didn't believe what I was seeing. Lesson? Fozz pointed out that the lows never broke the prior low - strong indication of an uptrend. Something to keep in mind. Also, looking at the chart now, I see only two potential real time entry signals: the 12:00 doji and the 1:20 red. Both of those may have been stopped, but there was some room for profit on the 12:20. I think it is probably a good idea to wait for the candle to form for the signal. Sure I will miss some early potential profits, but I think the odds are better (-$105.00):

UAUA: Short - an exit on the entry signal would have met with some profit. As it was I let it run to the stop and then went long. Scott mentions buying new highs/lows several times, but the strategy requires more discretion than I have: mine ending up getting stopped an awful lot. I can't see any difference between the 7:55 test of the high and the 8:30 test of the high, but the 8:30 failed. (-$18.00):

Another new high with a reverse on UPL. It might be better to play these new highs on the dip/return to trend (-$19.00):

VMW (-$14.00):

Expecting the reverse on the market rally and long on VXX. Then short (-$13.00):

Where oh where was the reverse on the rally? Definitely not to be found on WLT. I placed this short on a limit order - along with about 4 others - to get the price point, and I missed moving the stop after the order filled. By the time I realized the order was filled I was way out of bounds (-$31.00):

i didn't realize FTI collapsed like that.

ReplyDelete