I had some connection problems with NT and got started about 30 minutes late. As it turns out, NT. B14 is not yet compatible with TDA's data stream. I won't even have to try tomorrow =)

Morning session started with new high on BVN. I happened to buy right at the peak and stopped out in the same bar. I reversed and exited on the 8:15 doji. The 11:20 entry was a faltering new high (coinciding with the long greens on QQQQ and SPY). In the afternoon I tried another new high. I stopped out, reversed, and stopped out 2 bars over.

For comparison purposes - check out the Heiken Ashi chart of BVN (which I am trying to use for trend analysis, rather than the 15 min candle):

It looks so easy in retrospect...

Next was WLP on the TDA screener alert, long bar and breaking new high, after BVN's new failed I went short, cut the loss early and reversed, only to get stopped out on the long bottom wick on the next candle. Ouch. I bought in right away again and rode it up to the doji. I reversed right away, but changed my mind as it broke a new high again. Reversed again, stopped, shorted... and then I don't know what I did. It is hard to follow the action on a 5 minute chart:

Here is a 1 minute of the morning's action, for a better interpretation (though I confess this still leaves me wondering what I was thinking):

Anyhoo - after WLP the account was -$107.

Caught a little bit of profit on CE's new low, then caught some later in the morning. I tried to increase the size at 9:49 but exited on the next candle. The record shows I went long, but with the lack of volume and the market showing some downward movement, I exited. I called that completely wrong:

Zion caught my attention earlier, but I missed the new low. I was watching for a bounce, and came in a little late. Red, green, red green. With the +-$0.20 choppy wicks, it was too hard for me to call. Later in the day I tried the new low and managed to stop out on the long high wick:

Failed new high on AIG, stopped out in the same candle:

New low on USG, after some nice long candles. The 5-min doji probably should have been a heads up, but it lacked volume and I ignored it to much my chagrin:

Failed new low on DSW, stopped out:

That was pretty much it for the morning session. I went a little long (~9:40 my time), but the market seemed to justify it. It looks like I missed some 7:30 opportunities, but still plenty of entries. Just none of them that good. The account was at -$603 after DSW. I started trading again at 11:00.

SPY and QQQQ were extremely choppy the first part of the afternoon - note the long green followed by the long red a few bars over, followed immediately by the long green ~ the 11:30 and 12:00 mark. I guess I need to be ready for this as you can see in some of the trades - but how can anyone be ready for this?? Maybe more experience.

MET, ahh MET... thanks for trying to redeem the account. I entered on a new low, exited and reversed after it broke thru two previous opens, Stopped, and reversed. The next candle breaks thru previous open, so I reverse again, and get stopped. Reversed again, only to watch it break thru again. Rawr. Finally get it right at 11:36 and scale the position up at 11:59. The funky market action (long side by side reverse candles) and increasing volume kept me hanging on thru the bounce and subsequent dojis. I sold on the larger volume green and re-entered the short late for a slight loss on the exit:

Consistent new highs after the big green on the market looked like a good entry on TCK. Chop city. I finally got the last short about right:

New low failed on VLTR, tried again later and stopped out (hindsight says the days cumulative volume was way too low ~400k):

HUM was coming up with new highs all day with small candles and fizzling. I bought in after a dip and increasing volume, and stopped out (and unfortunately did not reverse):

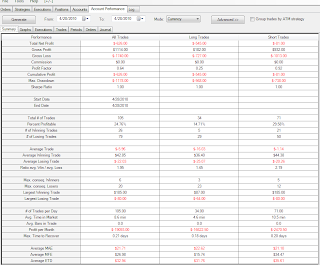

That was pretty much it for the day. 105 trades and no commissions on the P&L (since I entered the schedule incorrectly this morning). The stop loss worked well today, and I found out I can move it manually via the graphics, which will be better I think.

Hmm... comparing the day's trading patterns to FNG's 'The Finger' strategy, I think I am following it reasonably well in terms of entry. It seems I have a problem staying committed in the first candle, and not letting the candles play out, e.g., WLP (commissions would of put a serious dent in the account). Maybe I need to wait for the last minute of the candle prior to entering. I am just thinking out loud here, but I may as well be using one minute candles if that is the case. Which flies in the face of FNG's advice - a definite no-no at this point.

But for what it is worth:

NT has a pretty cool feature - something they call the bar graph. Here I have a 1 minute candlestick plotted on a 5 minute bar (WLP):

And perhaps even more interesting, a one minute Heiken on the 5 minute bar:

Looking at the 1 minute HA offers no justification for the ins and outs. Of course this is hindsight, and I am very reluctant to introduce something outside of what FNG explains and does so well.

As I was reviewing this post prior to publishing, I thought it might be good to post MET and ZION in the same format. Here is MET:

Here is the first trade on ZION:

And the second:

Looking at these, the MET trades appear justified. Zion entry looks good, but the reversal after the stop does not. The next short is ambiguous. The last exit looks early, but the HA has some pretty long wicks.

A good test would be to try some of these trades over again using NT's replay feature. Maybe I will tonight if I can find the time.

.

No comments:

Post a Comment