BYI saw some relatively good timing, but there was not enough movement:

I caught some of the up on ANN at 10:50, and tried to double at 11:15, bad decision (I need to remember to ask myself, double or get out?):

A little early on the entry, and I should have stopped out. I doubled at 11:15, only to stop out:

Wrong entry on HES (thanks to not having implemented the click/key combo yet), and then I couldn't make up my mind (REVERSE AFTER THE BIG CANDLE!!!). Caught some of the late action at 11:10, with good exit at 11:30. I re-entered right away, but forgot to pay attention and let everything get away from me. From then on it was more of a click fest - I finally gave up:

Good entry on NOV at 11:10... but I let this one get away as well. I was holding too many positions and not paying enough attention. Another click fest with some recovery. Silly me:

Stopped out of JOYG:

ITMN was a good entry, but this was the 11:10 slot that I let get away:

Good entry on BHI, covered the reverse, stalled, then stalled again:

AIG stopped out, bought again, stopped, shorted, and didn't wait long enough. By this time I was a little flustered (11:40):

The morning session saw some excellent unrealized returns (~$1000), but by ~11:10 I was in the 'Heh, this is easy, I know where everything is going' mode. A few stops on other trades and by break I was down $1400. What a shame.

I took a mental breather, a shower, and some stretch out meditation time as a confidence boost. I ran thru what I did during the morning session and I came to the conclusion that I was not constantly asking myself 'Does this stock know where it is headed?' It is not my job to tell the stock where to go, but rather to be constantly aware of where it is telling me it is going. My responsibility is only tag along for the ride. If the stock doesn't know where it is going, then I have no business in trying to give it direction. I determined for the afternoon session to maintain constant vigilance.

AVP... always reverse after the long candle. I couldn't make up my mind, and I found myself hoping for another rocket. Silly me. The reverses are almost - dare I say - predictable? I coulda/shoulda of played this like my ole geetar:

I tried a little too hard on CLF:

APC stopped out at 14:05 (a little late), tried to buy in at 14:35, and a click fest until 15:15, at which point I managed to tag along for a bit. I need to remember to just listen:

JOYG. I was too eager to read the reverse, and clicked in and out. Good clicking practice I suppose:

A new high on BHI, and a slight gain:

New low and AIG breaks my heart. I felt like minnow in the shark pen. Was not reading the action correctly. The yellow do nothing candle on low volume should have been the clue. If I remember correctly though, it started off green, coming off of the previous candle low:

Nice read on MHS. Slow and wave like. A little more confidence would have helped. But... I think I was trying a little too hard in the 15:30 bottom:

Failed at PVH, but good on the stops:

A failed new high on APH, but good tight stops:

MON; doubled at 14:45 on this one. I should have reversed on the next candle, but I was consumed with AIG at the time:

I think the afternoon session was a good response to the morning session. Today's lesson was one of constant vigilance. The morning saw me getting a little complacent - I was in the money, and for some reason just assumed I was in the slow trend of the day. Not a conscious thought, more of a relaxed 'I got this' attitude. This afternoon I did well enough, except on AIG. AVP was a gimme, but I felt some hope entering the picture. I was too quick on the draw for CLF and APC, especially given the relatively low volumes. The more clicks though, the more experience. Bound to get better.

Just glad this isn't real money =). Paper trading is offering a lot of freedom to move in and out. It feels good.

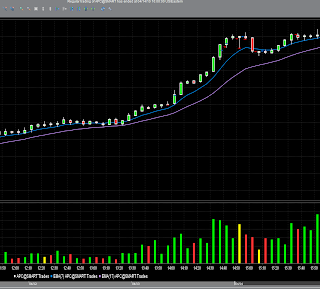

And here a >100 point gain on the DOW. Go figure. I thought I would have noticed more momentum bleeding over from QQQQ. I might need to check that out.

Dissertation research tomorrow, so no trading. Friday will be the money maker. Maybe.

No comments:

Post a Comment