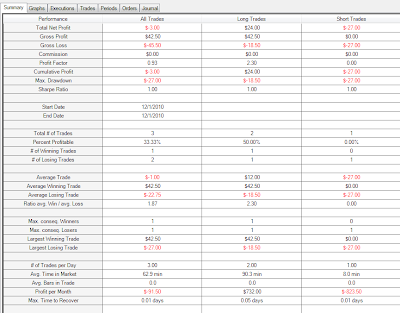

Summary:

Live trading on 50 shares today:I was at the screens all day, but didn't spot any opportunities till rather late in the day. Perhaps I am maturing as a trader...

There were opportunities this morning, just none that I spotted. NFLX signaled short at 10:25, but the spread was so crazy and the action so quick I decided to stay out. FFIV came up on the 12:30 but as sporadic as my success has been with that stock I opted to stay out.

Anyhoo - the trade on NFLX stopped out immediately, FFIV sputtered around until it came up with some direction, and AAPL had some honest $0.50 on it, but I opted to stay in and got stopped.

I delayed the blog entry today because I am puzzling over what to make of the range charts. I cannot for the life of me read anything out of them today. When it comes down to it, the information presented in a single bar is very limited, again, because the bars are lacking the time element. There are not very many different shapes the bars can take. The body always has to be on one end of the bar or the other. From what I gathered from Brooks, he started his journey by coming up with a profit target, and then examining price action just prior to any move large enough to hit his target. The problem with doing this on range bars is that the patterns are very limited.

I am posting the charts with what I have for now, but likely will continue to wrestle with them for a bit tonight. If I come up with anything I will post.

Trade well.

Details:

AAPLFFIV

NFLX

DTF, what's your plan for learning how to trade and why?

ReplyDeleteThanks for the question Gump.

ReplyDeleteMy plan for learning how to trade is:

#1 Find out as much as I can about myself and how I respond in and to trading scenarios. I plan on accomplishing this by gaining as much screen time as I possibly can and paying attention to me.

#2 Develop and adopt a trading style uniquely suited to my personality.

I am not sure what my approach will ultimately look like but Scott's and Brooks' price action approach are the most appealing. Right now this comes out as limiting my trades within the context of the MA, and spending time at the end of the day reviewing and taking apart price action.

It is a little like this, I think trading expertise is going to require in depth and perhaps even exhaustive familiarity with price action. Reviewing the day's price activity and coming up with my own descriptions forces me to pay attention to the price and I am thinking that this will eventually spill over into the day's trading:'Aha - I remember seeing something like before' moments. Kind of like when I 'know' that my espresso machine is running out of beans before it actually does - I notice/hear something that I can't describe, but I have heard it enough that I just 'know' what will happen. This will be some confluence of personal self-acknowledgment and experience. Then I will take off the MA training wheels and go for it.

This might sound a bit crazy - but I think there has to be some balance between sticking to some methodology or systematic approach and letting it 'work', yet remaining open to new ideas and the 'unknown'. I can only say that this journey is mostly about self discovery and finding what works for me.

DTF, consider the implications of substituting the phrase "for learning how to perform surgery" for "for learning how to trade".

ReplyDeleteWould you as an intern perform the surgery in a way unique and what feels good to you?